Header: Understanding the Importance of Decentralization

11 min read If you are familiar with the concept of cryptocurrencies, then odds are you are also familiar with the term "decentralized." Despite what you may believe, not all cryptocurrencies are decentralized. Nevertheless, we believe that this is an essential component of cryptocurrencies that has to be given priority. So, what is decentralization, and why is it important? Read on to find out more and why you should care about decentralization in the cryptocurrency world. May 31, 2024 00:16

If you are familiar with the concept of cryptocurrencies, then odds are you are also familiar with the term "decentralized." Despite what you may believe, not all cryptocurrencies are decentralized. Nevertheless, we believe that this is an essential component of cryptocurrencies that has to be given priority.

So, what is decentralization, and why is it important? Read on to find out more and why you should care about decentralization in the cryptocurrency world.

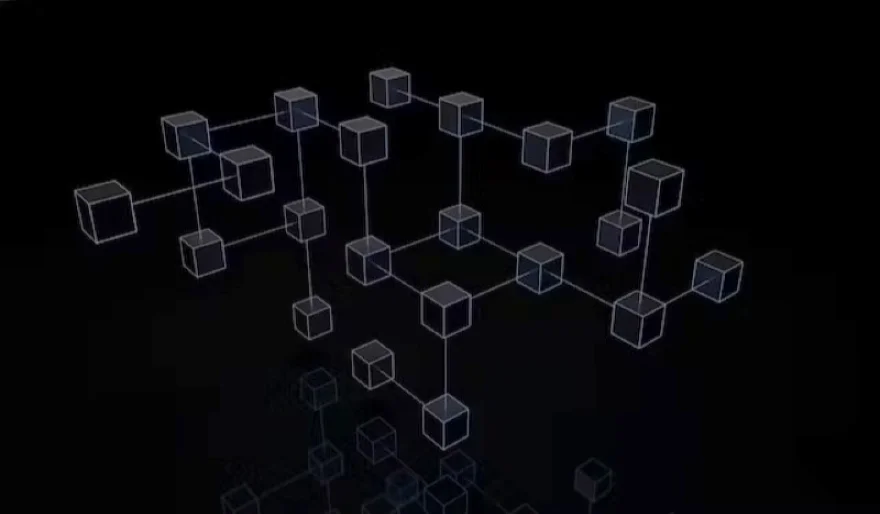

What is decentralization?

Decentralization refers to the process of distributing power over a certain subject across a number of different bodies. On the other hand, this is the antithesis of centralization, which is when one firm or institution dominates everything. Through the process of decentralization, authority is successfully divided, guaranteeing that no one individual is able to make changes based on their own personal wishes.

Related: Is Meta’s Decentralized Twitter the Real Deal?

How does decentralization relate to cryptocurrencies?

Prior to delving into the topic of decentralization in cryptocurrency, it is imperative that we first examine the concept of centralization and the effects it has on fiat currencies. In the case of fiat currencies, a single government is the institution that exercises power over the currency. Centralized currencies are ones that are controlled by a single entity.

You need to be aware that this gives the government complete control over the source of the money and, ultimately, your life. Although it is great to leave the printing of money to the government, enabling them to carry out the expenses and distribution, you should be aware that this gives them complete power. The centralized entity regulating your funds may do anything they please with it. They may print more (create inflation), withdraw some from circulation, or even take it from your hands.

This implies that even if you have lawfully earned cash, it doesn’t belong to you; in fact, it may be taken away or frozen at any moment. In prior ages, this was less of a worry since governments had less authority over ordinary life. But in recent years, due to technology, the government has started to delve into the lives of individuals, penalizing them for behaviors that were formerly deemed innocuous.

As a consequence, the power of the average citizen has eroded. Even having the ability to vote in certain nations, the typical citizen is at the whims of their local government, and there is little they can do to protect their future other than pray that the government always acts in their favor.

Because of these increasing problems, individuals in the early 2000s wanted to create a currency that wasn’t controlled by the government. This would give them the power to secure their future and prevent the government from being able to take their funds on a whim.

This decentralization in cryptocurrencies is typically achieved through the use of a consensus mechanism, which allows all users of the currency to vote on changes made to the blockchain rather than having a single person make decisions.

Although this is a useful method for decentralizing currency, not all cryptocurrencies are decentralized because decentralization raises security and volatility risks.

Why is decentralization crucial to the cryptocurrency space?

Decentralization is crucial in cryptocurrencies because, without it, all you have is another government-sponsored currency. But, unlike the government, which has checks and balances to make things fair, a centralized cryptocurrency is generally managed by a firm or someone who may take away that coin at any point, leaving you with nothing.

Because decentralization leads to higher volatility, many individuals incorrectly feel that buying a centralized cryptocurrency would provide them with some safety. The reverse is really true. The more centralized a cryptocurrency is, the more hazardous it is (since it might easily be erased or taken from your account). In reality, it is encouraged to only acquire decentralized cryptocurrencies since they offer a few protections—not from volatility but from one individual being able to take your crypto away.

That being said, note that not all decentralized cryptocurrencies have these safeguards, particularly young and untested initiatives. After you discover a cryptocurrency is decentralized, you need to conduct some research before you invest to ensure you trust the platform and the software, since even if a project is decentralized, all it takes is one hacker, and you still may lose everything.

centralized cryptocurrency

The most prevalent centralized cryptocurrencies are BinanceCoin, Unus Sed Leo, and OKB. All these currencies are administered by a firm and don’t necessarily balance the power among the users. Of course, they have a use, but it is not suggested to invest in these cryptocurrencies unless you are utilizing a linked site and require crypto to do so.

Digital Assets Without Centralization

The most famous decentralized cryptocurrencies are Bitcoin, Dogecoin, Monero, and Litecoin. Now, this doesn’t imply that buying these cryptocurrencies is secure, but acquiring all these coins assures you that you are becoming part of a decentralized ecosystem rather than purchasing a cryptocurrency held by a single person.

Related: XMR Monero 101: Untraceable Cryptocurrency

Stablecoins: How decentralized are they?

This is a bit of a tricky topic to answer since certain stablecoins may be created on decentralized protocols. But one of the drawbacks is that most stablecoins, even if decentralized, are tethered to a fiat currency. This implies that when the value of that fiat currency fluctuates, so too does the value of the stablecoin.

To clarify, stablecoins do play a role in society since they simplify the process of sending and receiving currency in other currencies. This is not to say that they are not useful. With that being said, we do not advocate them as investment vestibules since they are still very susceptible to the misconceptions that are associated with centralized currencies.

Ethereum: is it decentralized?

From a technical standpoint, Ethereum is a blockchain platform that is decentralized. Using a proof-of-stake consensus process, each and every transaction that takes place on the system is controlled. On the other hand, it is essential to be aware that Ethereum is not as decentralized as other cryptocurrencies, such as Bitcoin and Monero, have been.

This is due to the fact that Ethereum is a corporation, and any modifications that are made to the blockchain need to be authorized by Vitalik Buterin or other members of the firm. Despite the fact that this gives Ethereum some enhanced opportunities for innovation, it does take away some of the decentralization features of the cryptocurrency.

As an example, we believe Bitcoin to be a platform that is really decentralized. All modifications to the blockchain are subject to the approval of miners and users via a voting process, and the modifications cannot be implemented unless they get a majority vote. Due to this, Bitcoin is a fully decentralized cryptocurrency.

This doesn’t imply Ethereum is terrible, since it is still wonderful software. Just be aware that it isn’t totally decentralized, and modifications will not be done in the same manner as on a truly decentralized platform.

You May Also Enjoy: Centralized vs Decentralized Gambling

This article was brought to you by Crypto Sports Betting on MintDice. Originally posted to MintDice.

User Comments (0)

Popular Apps

Editor's Choice